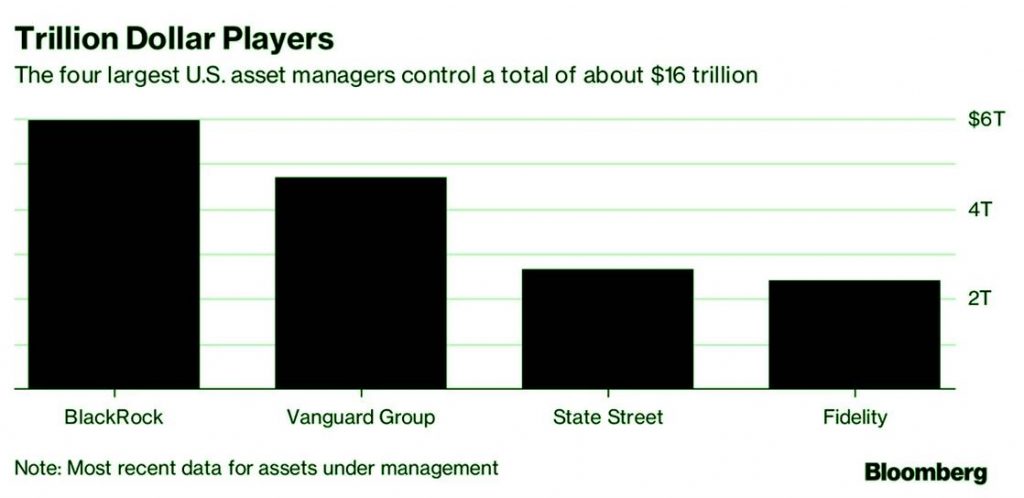

Blackrock and Vanguard have $20 trillion, so they could control almost everything by 2028

We are not yet at a tipping point. According to Savita Subramanian, Bank of America Corp., roughly 37% of U.S.-domiciled equity fund assets are now passively managed. This is an increase from the 19% in 2009.

If you look around the world, there’s still much to be done: Only 15% of global equity markets, including funds, separately managed accounts, and holdings of individual security, are passively managed according to Joe Brennan (global head of Vanguard’s equity index group).

BlackRock and Vanguard’s dominance raises concerns about governance and competition.

Research from the University of Amsterdam has shown that the companies own more than 5% of the more than 4,400 stocks in the world.

This is making regulators nervous. In February, Kara Stein, SEC Commissioner, asked Kara Stein: “Does ownership concentration impact the willingness of companies to participate in the market?” A study by Jose Azar (assistant professor of economics at IESE Business School), found that airfares rose by as much as 7 percent over the 14-year period. BlackRock and Vanguard are the largest shareholders of the three largest operators.

Azar stated in an interview that BlackRock and Vanguard are growing and as money moves from passive to active investors, their percentage share of each firm is increasing. “If they exceed the 10% threshold, I believe for many people that it would make it more clear that the growth in large asset managers could cause serious concerns about competition in many industries.”

BlackRock called Azar’s research “vague” and “implausible”, while other academics have questioned Azar’s methodology. Edward Rock is one of them. Rock, a New York University law professor, says that stakes higher than 10% are discouraged. He favors creating a safe harbour for holdings of up to 15% to encourage shareholder engagement. These firms hold large amounts of shares in some of the largest companies worldwide, including Google parent Alphabet Inc. and Facebook Inc. in technology. They also have loans from Wells Fargo & Co. According to their reports, the U.S. companies supported or opposed 96% of the management resolutions regarding board directors during the year ended June 30.

Vanguard’s Brennan said that while we have put more effort behind it, they have always made a significant effort. “We are long-term permanent holders and, due to that, we have the strongest interests in the best outcomes.” Companies could also benefit from their size. According to the website, both firms were the first to join Investor Stewardship Group. This group is made up of institutional asset managers who seek to improve corporate governance. Vanguard has increased the number of people who are dedicated to climate change advocacy by more than doubling its staff over the past two years. It also supported two shareholder resolutions related to climate change. BlackRock employs more than 30 people to interact with its portfolio companies. These developments will be closely monitored by active managers. Although many acknowledge that it is difficult to stem the tide of passive income, some may be able to see better days when central banks begin to unwind a decade-long period of easy monetary policy which has reduced volatility.

Data shows that active managers are performing better. Data from S&P Dow Jones Indices shows that 57% of large-cap stockpickers outperformed the S&P 500 for the year ended June 30. This is compared to 85 percent the previous year. If indexing creates a market that is easier to beat, investors will flock to stockpickers, according to Richard Thaler, Nobel laureate, and professor at Fuller & Thaler Asset Management.

Despite the fact that the duo is advancing at an unstoppable pace, some structural problems may be outweighed by the potential benefits of low-cost investments.

Thaler stated, “Given their growth so large because of their fees being so small,”

<< Previous