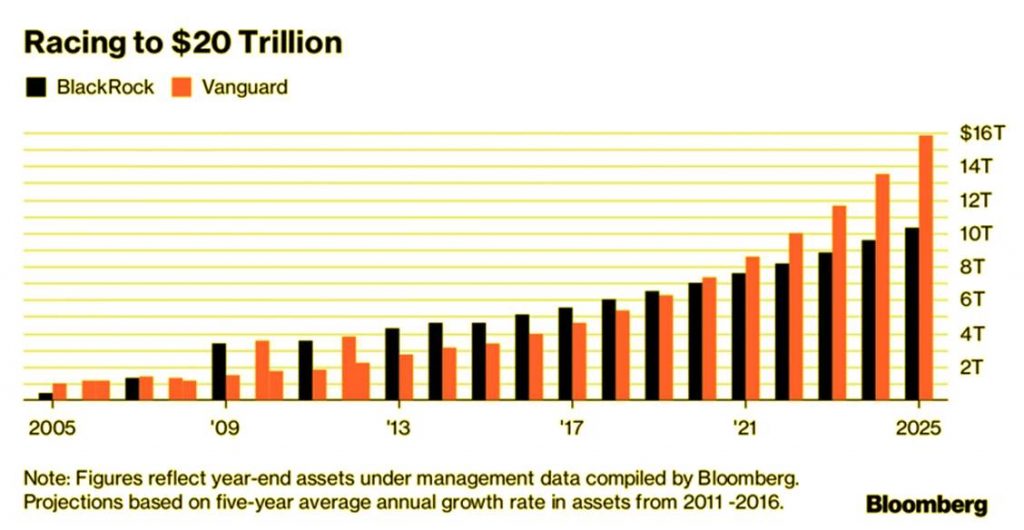

Blackrock and Vanguard have $20 trillion, so they could control almost everything by 2028

This duo has attracted investors from all walks of the investment spectrum, including individuals and large institutions like pension and hedge funds. They are popular because they offer low-cost funds and a wide range of options. These firms are also being impacted by the proliferation of exchange-traded funds and this trend will continue.

Jim Ross, State Street’s global ETF chairman, estimates that the value of global ETF assets could reach US$25 trillion by 2025. Based on their current market share, this sum would translate into trillions of additional dollars for BlackRock or Vanguard.

John Woerth, the Vanguard spokesperson, stated that growth is not a goal and that projections of future growth are not made.

Passive funds, while larger may seem better for fund giants, may obscure the intrinsic value of securities. This could be due to the fact that passive funds are implied in earnings or cash flows and may make it harder to determine the true value of securities.

Arguments like this are made: With the explosion of passive funds driving the demand for securities within these benchmarks rather than the wider universe of stocks or bonds, the number of indexes is outpacing U.S. stocks. This could cause an increase or decrease in the price of these securities relative to similar un-indexed assets. These can lead to bubbles and volatile price movements.

According to Goldman Sachs Group Inc., stocks with large exposures to indexed funds might trade more on cross-asset flows or macro views. According to the bank, 77% of the S&P 500 stock average might trade on fundamentals compared to more than 90% a decade ago.

This is not the experience of BlackRock. “Index investing does play a part, but the price discovery process remains dominated by active stock pickers,” Barbara Novick, Vice Chairman, wrote in October. She cited the low turnover and small-size passive accounts in comparison to active strategies.

Larry Tabb, founder, and CEO of Tabb Group LLC in New York, said that another concern is the lack of the possibility of being included in an index. This makes it less attractive for small and mid-sized businesses to go public. He said that their stock could be underperforming if they are not included in an ETF or index. The selection of benchmarks is governed by rules and a methodology. Some require that security have a certain size or liquidity to be included in an index or ETF.

<< Previous Next >>